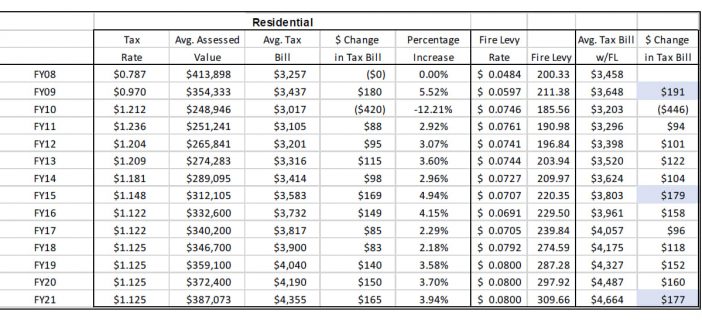

prince william county real estate tax payments

Make a Quick Payment. July 2 2022.

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

Who do I contact to get one in Virginia County Prince William.

. Ad Check the Current Taxes Value Assessments More. Prince William County has one of the highest median property taxes in the United States and is ranked 120th of the 3143 counties in order of. Prince William County real estate taxes for the first half of 2020 are due on July 15 2020.

Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs. All you need is your tax account number and your checkbook or credit card. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022.

When prompted enter Jurisdiction Code 1036 for Prince William County. You can pay a bill without logging in using this screen. In Prince William County Virginia the tax rate is 105 which is substantially above the state average.

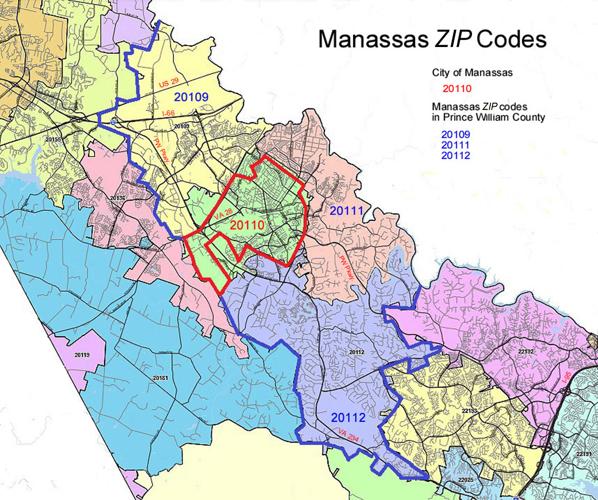

Enter the Account Number listed on the billing. Use My Location Manassas. By creating an account you will have access to balance and account information notifications etc.

The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. -- Select Tax Type -- Bank Franchise Business License Business. Learn all about Prince William County real estate tax.

Find Prince William County residential property tax records including land real property tax assessments appraisals tax payments exemptions improvements valuations deeds mortgages titles more. Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Search in Prince William County Now.

Then they get the assessed value by multiplying the percent of total value assesed currently 100. Make checks payable to Prince William County. Discover the Current Taxes What the Real Cty Assessor Thinks the Land Is Worth.

For more information please visit Prince William Countys Department of Real Estate Assessments or look up this propertys current valuation. Then they multiply that by the tax rate to get your property tax. Advance payments are held as a credit on your real estate personal property or business tax account and applied to a future tax bill when the tax rate and assessment are set or when you file your business tax return.

Hi the county assesses a land value and an improvements value to get a total value. You can read more at Propety Taxes in. Report a Change of Address.

How property tax calculated in pwc. Search 703 792-6000 TTY. The Prince William County Department of Finance reminds residents that personal property taxes are due on or before Monday Oct.

Para pagar por telefono por favor llame al 1-800-487-4567. To make matters worse for residential property owners property tax bills. Median Property Taxes Mortgage 3893.

I havent received my property tax bill yet. 300000 100 x 12075 362250. By mail to PO BOX 1600 Merrifield VA 22116.

Press 2 to pay Real Estate Tax. Enter the Tax Account numbers listed on the billing statement. Payment by e-check is a free service.

This estimation determines how much youll pay. Click here to register for an account or here to login if you already have an account. A convenience fee is added to payments by credit or debit card.

Press 2 for Real Estate Tax. Treasurer Tax Collector Offices near Woodbridge. Prince William County Property Tax Payments Annual Prince William County Virginia.

Siga las instrucciones e ingrese el codigo de jurisdiccion 1036 para seleccionar el. Prince William County collects on average 09 of a propertys assessed fair market value as property tax. When tax assessors estimate the value of your property they multiply that number by the tax rate of the county.

Press 1 for Personal Property Tax. They pay back the previous owners at the juncture. Free Prince William County Property Tax Records Search.

Provided by Prince William County Communications Office. Report changes for individual accounts. Prince William County real estate taxes for the first half of 2020 are due on July 15 2020.

By phone at 1-888-272-9829 jurisdiction code 1036. Purchasers are now required to remit the tax. You will need to create an account or login.

There are several convenient ways property owners may make payments. Median Property Taxes No Mortgage 3767. Please contact Taxpayer Services at 703-792-6710 M-F 8 AM 5 PM.

Prince William County is located on the Potomac River in the Commonwealth of Virginia in the United States.

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenova Com

Prince William Board Of County Supervisors Adopts Fy2023 Budget Prince William Living

Prince William Wants To Hike Property Taxes Introduces Meals Tax

Prince William Co Residents Decry Proposed Hike In Tax Bills Wtop News

Join Renew Realtor Association Of Prince William

Prince William County Virginia Businesses For Sale Buy Prince William County Virginia Businesses At Bizquest

Digital Realty Ups The Ante In Data Center Alley Data Center Knowledge News And Analysis For The Data Center Industry

Guest Column When Is Manassas Not Manassas Opinion Princewilliamtimes Com

Personal Property Taxes For Prince William Residents Due October 5

National Park Service Prince William Forest Park Sign Virginia Travel Forest Park National Parks

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Deadline Extended To Pay Real Estate Taxes For Second Half Of 2020 Prince William Living

5572 Saint Charles Dr Woodbridge Va 22192 Saint Charles Dale City Keller Williams Realty